With the global demand for protein growing and expected to double by 2050, so is the level of greenhouse gas emissions associated with its production, now estimated at 14.5% of all man-made emissions. The light is now pointed towards alternative protein production methods. In fact, by removing animal farming from the equation, companies are putting their efforts into novel technologies to meet the current and future protein needs. According to a study from AT Kearney, 60% of the global meat market will be represented by alternative protein by 2040.

As the sector keeps growing and new technologies continue to emerge, the alternative protein space is becoming increasingly complex to understand. In this article, we take a step back in order to try and explain what the alternative protein sector is all about, and where it is heading.

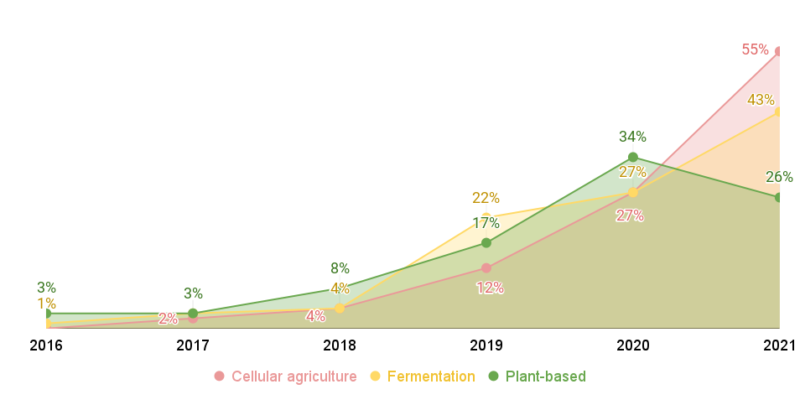

Plant-based, Fermentation and Cellular agriculture are the three main methods currently in use to produce protein-rich foods without the need for animal farming. While all three have advantages over animal-based products, fermentation (which together with cell-agriculture is known as biotech) has experienced the steepest funding growth with a 79% CAGR since 2018. On the other hand, investments in companies working on plant-based proteins grew at a 32.3% CAGR during the same timeframe but saw global retail sales reach $4.2b in 2020.

Yearly percentage of investments out of total invested by technology show that increasingly more capital is being invested in cellular agriculture and fermentation companies. Source FoodTech Data Navigator

Plant-based

Companies making plant-based substitutes for meat and fish were the first ones to appear on the market due to the relative ease of production. The key to this method lies in the selection of the right ingredients, which can be blended together in order to obtain a product that is comparable to animal-based ones both in appearance and protein content. Recently, the roster of available ingredients has been expanded to include legumes such as peas and lupins, which mark a step toward a wider adoption compared to soy, which is more water-intensive and is an allergen for many. New processing techniques have emerged to create better-looking “muscle” fibres in addition to the predominant extrusion (pushing fibres through increasingly reducing circumferences): 3D printing enables the manufacture of complex structures thanks to the precision of the machines; Shear-cell technology, which works by squeezing proteins between two cylinders, resulting in more fibrous textures; Spinning technology creates a whole-muscle-like texture thanks to the centrifugal force applied to plant proteins.

Plant-based proteins production process and outputs examples

Fermentation

While the use of fermentation for manufacturing protein-rich foods and the resulting animal-substitute products isn’t a new process (it has been used to make yogurt, beer, cheese etc for millennia), some of its iterations are innovative and can now be achieved through three main techniques:

- Traditional fermentation is the oldest of all kinds of fermentation, and it is achieved through microorganisms that alter the composition of plants ingredients through a metabolic process, resulting in different flavours and textures;

- Biomass fermentation is a clever way of leveraging the natural behaviours of particular microorganisms such as fungi’s propensity to grow quickly. Because they are not part of the plant kingdom, their molecular composition makes them suitable ingredients for products that closely resemble their animal-based counterparts. Quorn is a company that has been active in this space early on and that has helped popularise it, also thanks to their early coining of the term “mycoprotein” (protein from fungi). New takes on this approach have recently come from players like Meati, which aims to produce whole cuts with it;

Meati’s “steak” Credits Green Queen

- Precision fermentation is the newcomer of the group and the most “complex” process. Companies using this approach generally utilise microbes that have been genetically instructed to synthesise particular proteins during their metabolic process, effectively brewing them. This technique allows for a wide variety of applications and outputs, including – crucially – casein and albumin. Perfect Day and Clara Foods are great examples of the successful implementation of this new technology at industrial levels. The former has successfully made milk without the use of cows, while the latter is now rolling out its egg replacement products.

Proteins fermentation production process and outputs examples

Cellular agriculture

Cellular agriculture, despite being commercialised in the early 20th century with rennet and insulin, has started seeing concrete developments only in the last five years or so. In this method, some cells are humanely harvested from an animal, and then triggered to multiply under controlled and ideal conditions (in a chamber called bioreactor) thanks to a culture medium (a highly nutrient environment) fixed onto a structure called scaffolding, which companies like Matrix Meats and Novel Farms are working on improving to break free completely from animal dependency with the use of nanotubes or synthetic biology respectively. Compared to the plant-based and fermentation techniques, cellular agriculture has the obvious advantage of allowing the production of 100% real animal tissue, without slaughtering animals. However, the growth medium mostly used is currently still sourced from fetal bovine serum and research is underway from companies like Multus Media and Biftek to reduce the cost of the animal-free alternatives. Additionally, cell agriculture has the potential to create multi-layered foods – such as marbled beef – without the combination of multiple products, although this technology is still in its early stage of development.

Cellular agriculture production process and outputs examples

A recipe for success

In addition, some of the most successful companies in the space are also using a different approach which involves leveraging combined technologies to develop compelling animal-free foods.

A great example of this is Impossible Foods, which took the F&B industry by storm back in 2016 when it introduced a plant-based patty that bled when cooked. Beyond their unquestionably brilliant branding and marketing, their success is also due to the clever combination of a plant-based core ingredient with a precision fermented one called heme, normally be found in beef, which is responsible for the “beefiness” and bleed of their “meat”.

Impossible Foods burger patties

Credits Impossible Foods

More companies are now following this approach, such as Superbrewed Foods and Formo. Their latest funding rounds ($45m and €42M respectively) are strong signals that the market is following through.

Crucially, companies working with biotech technologies are choosing to also leverage B2B channels to enhance and diversify their revenue streams, providing ingredients or components to other businesses active in the space. Indeed, many players have decided to focus on this model in order to widen their market penetration (e.g. Perfect Day supplying fermented milk for vegan ice creams).

Other startups have instead focused on specific components, such as fat or culture medium, and would be looking at acquisition by bigger companies to implement their solutions (e.g. the Belgian Peace of Meat was acquired by the Israeli MeaTech in December 2020 for $18m for its cultivated fat). More recently, on the cellular agricultural side, the seafood developer Shiok Meats has acquired a fellow Asian company Gaia Foods, expanding its product research into red meat. Both acquisitions are important signals of the burgeoning activity around companies using biotechnology to produce alternative proteins.

A look beyond alternative proteins

Insect proteins

In the runup to alternative proteins, a cost-effective, simple and sustainable solution to implement is insect farming. With a wide array of feeding options and low maintenance needs, this space represents an opportunity that companies and investors are increasingly looking to capitalise on. Recent developments in regulatory processes (e.g. European Commission approving yellow mealworm for human consumption) and record investments in the space (Ynsect raised $224m in October 2020), point toward insects being a concrete alternative to traditional animal proteins. While companies in the space are mostly targeting animal feed and pet food sectors for the time being, we can expect to see more insect protein in our future

Non-food applications

The biotechnologies discussed above are also being applied in sectors that aren’t necessarily a direct part of the F&B industry. Modern Meadow and Debut Biotech are taking cellular agriculture into new arenas, tackling animal-based materials such as leather, or chemicals such as fertilisers, in order to reduce their production impact. Similarly, companies stepping out of the food and beverage sector are implementing fermentation technologies in other areas too. Great examples come from Afyren – which produces biosourced organic acids generally derived from petroleum – and Conagen – that leverages its innovative metabolic pathways to serve the chemical, pharmaceutical, cosmetic and pharma industries among others.

Do you want to learn more about the alternative protein space, the challenges it faces and opportunities you can harness? Access our Food Data Navigator HERE to discover all the companies analysed in this blogpost, or get in touch HERE for a tailored consultancy.